The COVID-19 emergency management is only a matter of data

The world is not changing. The world has already changed.

These last weeks, we had to learn to grow up as if we had never grown up at all, rewriting rules, changing all our plans. Italian companies, above all, are facing a chaotic phase and are struggling to understand how the market will evolve. This is emergency management in its purest application.

But, as we use to say in times like these, when a crisis spreads, some cry and some start selling tissues.

Our role now is to make sure that nobody cries anymore.

The “survival of the fittest” is the most important concept in nature. To us, human beings, it involves technologies and data: our crises are so complex that only by adopting a data-driven approach we can hope to turn them into opportunities.

“In Data We Trust”: this must be our motto.

To this end, I took down a list of crucial data-points that you have to care about in the following paragraphs, hoping that will be useful to support your Business.

The most useful data available today and how to apply them

The only data you need to care about are consumer-related ones. Taking decisions based exclusively on stocks metrics, at this time, can lead you to completely miss the point.

Nowadays, arbitrage and institutional initiatives like the Federal Reserve’s 1 trillion pump, may obscure the real consumers’ intentions.

In an emergency management context the main company goals are two:

- Find market opportunities to differentiate financial risks.

- Replan the core business strategy to avoid churn, save costs, and make it ready to relaunch your business as soon as possible.

Real market and consumer data are the major sources of information to achieve these goals before the tipping point.

In the following paragraphs, I will show you some examples of data and technology your business has to focus on:

Do you want to know why large enterprises prefer Digital Consumer Intelligence? Watch our Digital Consumer Adventures webinars.

Experts from large companies, such as Deloitte, Group M and ENI have already found an innovative way to use this technological cookieless model for their creative strategies.

1. Consumer needs

We can see here that people’s needs radically changed in a few weeks. Nobody has been able to match them in time and business models suffer the obsolescence of their value propositions.

Trying to understand how consumer needs evolve before your competitors do so is the best way to both set up a rapid reaction and empower your Brand Reputation perception. Which, as you surely know already, will help you in your future activities, too.

In Italy, where the quarantine first started, we have a lot of data about COVID-19-related needs.

People now are staying at home and no one seems to know what they really want. The truth is that Italians are screaming, not on the balcony but on social media and forums.

By listening to millions of online conversations and analyzing them through Artificial Intelligence, you are able to understand and satisfy their needs.

Also, if you are a non-Italian company, you will able to predict your country consumers’ needs just by looking at how the Italians scenario evolves.

For example, we fond out that nearly 100% of companies here think that the main Food & Beverage need is the online grocery service. That isn’t properly true. Actually, the real Italian need is delivery time.

We wrote an article about Delivery problems a couple of days ago.

Using insights like that, you can think about improving your Business Model on the delivery service section and target the geographical areas where the need is felt the most, thus giving priority to your expansions investment plan.

Moreover, you will be able to find out particular needs that you can satisfy by simply optimizing your current assets and developing a new value proposition.

2. Consumers confidence index (CCI)

Consumers’ confidence index “is based on the premise that if consumers are optimistic, they tend to purchase more goods and services, which should, inevitably, stimulate the whole economy” – (source).

Today, it represents a barometer of the health of the U.S. economy.

This Index is much more useful than other financially related tools because it is the reflection of real consumer spending intentions.

Looking at the Consumers Confidence Index you are able to answer some crucial questions:

- When will people come back to buy?

- How high is the decline in demand for goods?

- When should I return to invest? In which of my business areas?

- How should I reallocate my budget in order to optimize it on the current situation?

- Where are people most willing to buy my products?

- …and so on.

However, taking into account the official CCI made by The Conference Board for your business decisions have his pros and cons:

Pros:

- It’s both a leading and lagging indicator. A decrease in spending today may confirm an ongoing dip of the demand; however, a rise or fall of the index is a strong indicator of the future level of consumer spending.

- In the U.S. it is strictly connected to the U.S. economy trends.

Cons:

- It’s only updated monthly. In an emergency management environment, it could be better to consider shorter-term indicators to plan at least with a weekly vision, if not directly with dynamic data.

- CCI is generalized to the whole economic trend. It is difficult to understand which industry will be overcoming the crisis first.

- It has notable geographical limitations. There is no overview split between countries.

- It is solely based on survey questions.

However, this index, in spite of the limitation it bears, represents a powerful indicator to adjust your investment in a long term view.

3. Consumers’ search trends

Consumers’ search trends don’t represent needs, but desires. It implies that is not a necessity for consumers, but they are willing to buy something that they can’t find at this moment.

In Italy, a relevant online search is related to Dust-Masks.

Taking a constant look at searches you will be able to understand which products people are searching for and try to link them with your business.

For example, in these days, we notice that a lot of Startups or SMEs are converting their core business into Dust-Mask import or production.

However, using just searches Data isn’t enough.

In fact, thanks to our Digital Consumer Intelligence platform we find out that if the financial numbers go up, the reputation level goes dramatically down.

If you’ve in mind to join the masks business, I suggest you use them as a gift for your customer. Maybe you will suffer a little loss, but this way, you will increase your sales volume in the short period and consolidate your customer relationships for the long.

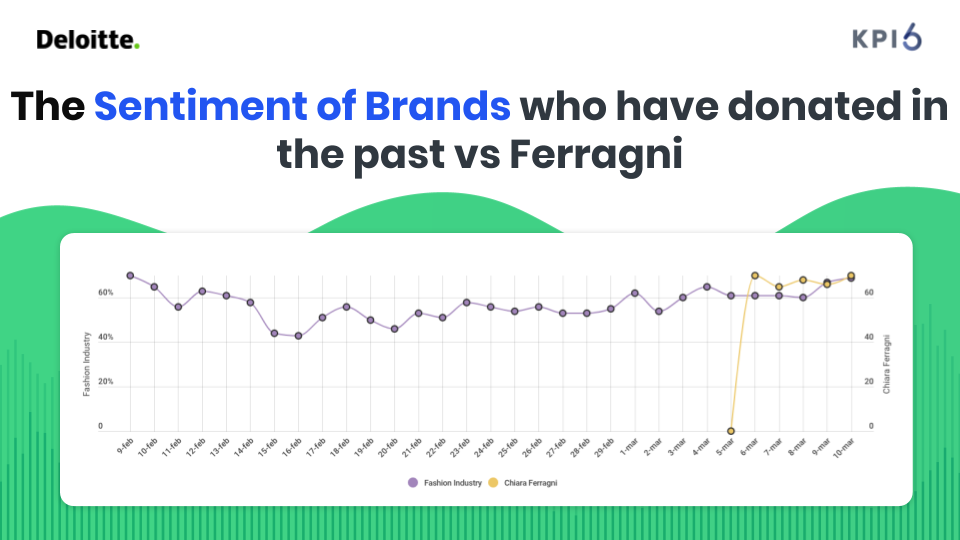

A little recommendation: Solidarity is crucial. If you’ve got the power to do this, do it now. Last week, we showed how Chiara Ferragni, with a single initiative, positioned her Brand on the same Social Responsibility perception level of the big Fashion brands who donated notable amounts of money to fight the COVID-19 outbreak.

4. Consumer behaviors

Consumer behaviors have to be rewritten from scratch. Yes, that might sound scary, but it’s the truth.

Forget people who walk in the streets looking at your showcase or being affected by your offline activities.

Even if this crisis, how we hope, will stop in the next weeks, consumers’ behavior has changed forever.

A new model of society will take place in the future. People will be attracted more and more by service-related business; they will be more safety-focused, more digital addicted.

If you planned a new digital service, this is the right moment to put it out from the drawer and to show it to customers.

Chances they will adopt it and keep it in the future have never been so high.

So, try to map the new consumers’ behaviors with a new Market Research and heavily invest in digital service for your consumers’ audience.

Technology to extract and analyze Consumers’ Data

Artificial intelligence is our best ally to fight the actual crisis.

Thanks to AI we can put all those Data together, analyze them, and arrange them in a visual way functional to a Manager’s decision process.

In order to understand your customers’ needs, listening to online conversations is essential. Social media and forums are the new places, and it will be the same for the other countries who no longer have restrictions on social gatherings.

Searches could be found using insights tools available on the major search engines, for example, Google Trends.

However, as I said above, you have to be extremely cautious when you think you found an interesting search. Try always to go deep inside the phenomenon to avoid the risk to turn an opportunity into another crisis.

Consumers’ behavior needs Market Research. To do this, KPI6 released last week a new feature to survey more than 60 million panelists over the world.

Moreover, if you have a KPI6 account you can use your Audience data to avoid the screening phase and save a huge part of market research costs.

Finally, after we understood the relevance of the Confidence Consumer Index, we decided to work on an Index that keeps the pros of the CCI while solving its cons. This Index, that we will show you next week, will change forever the old approach to consumers’ confidence and it will help companies understand and predict consumers’ spending intentions, both in an industry and towards a certain company.

And that’s not all!

In the next months, KPI6 will release a lot of new disrupting features that will radically change the Market Research industry forever. So, keep in touch with us.

Have you enjoyed this article and do you want to know more? Watch our Digital Consumer Adventures webinars.

Experts from large companies, such as Deloitte, Group M and ENI have already found an innovative way to use this technological cookieless model for their creative strategies.